Freelancing is more than ever a deliberate career choice for many in the advertising and digital industry. It provides a legitimate path to grow your craft, work on interesting projects and learn the ropes of being an accountable consultant.

A lessor-discussed benefit of freelancing is that it gives people the chance to learn how to run their own business which in itself provides a wealth of commercial and life lessons. Yet for many this part of freelancing can be a little bit daunting.

In this blog post, we break down the critical elements that a Freelancer should consider when setting themselves up as a business.

1. Create a business plan

Creating a business plan is a critical discipline in thinking through and documenting all key facets of your plan as a freelance business. By doing so it crystallises the activities and where your focus needs to be.

It certainly doesn’t have to be ‘war & piece’ or a set format. It should however at a basic level answer these questions:

Your Business

- What’s your business name and how do you describe yourself?

- What do you specialise in?

- What don’t you specialise in?

- What ongoing training is required to ensure excellence in your field?

- What is the market (level of demand, location) for your skill and going rates?

- Clients you have and want to chase.

Financial plan

- What income do you need per month?

- How many days of the week will you work?

What is your day rate/hourly rate? Or will you charge by deliverable? - How many days of the week will you work?

- How many hours per week do you expect to be billable?

- What are your expenses?

Marketing plan

- How will you find your clients?

- How will you promote you and your work?

- What are your targets from your marketing efforts

Note: these questions are modified from a great article by Brent Galloway.

2. Make yourself official

AU: To work as a freelancer in Australia, you need an ABN at the very least. You also have to decide whether you’re a sole trader, partnership or company, and whether you want to register for GST straight away. There are pros and cons to each option, but many freelancers choose to start as a sole trader without GST registration, with the knowledge that they can scale up from there at any time. Once you are earning over $75k, you will need to register for GST. You can apply for an ABN at register.business.gov.au/

UK : To set yourself up as a sole trader in the UK you need to register for a self assessment and file a tax return each year

3. Select your Invoicing & timesheet tools

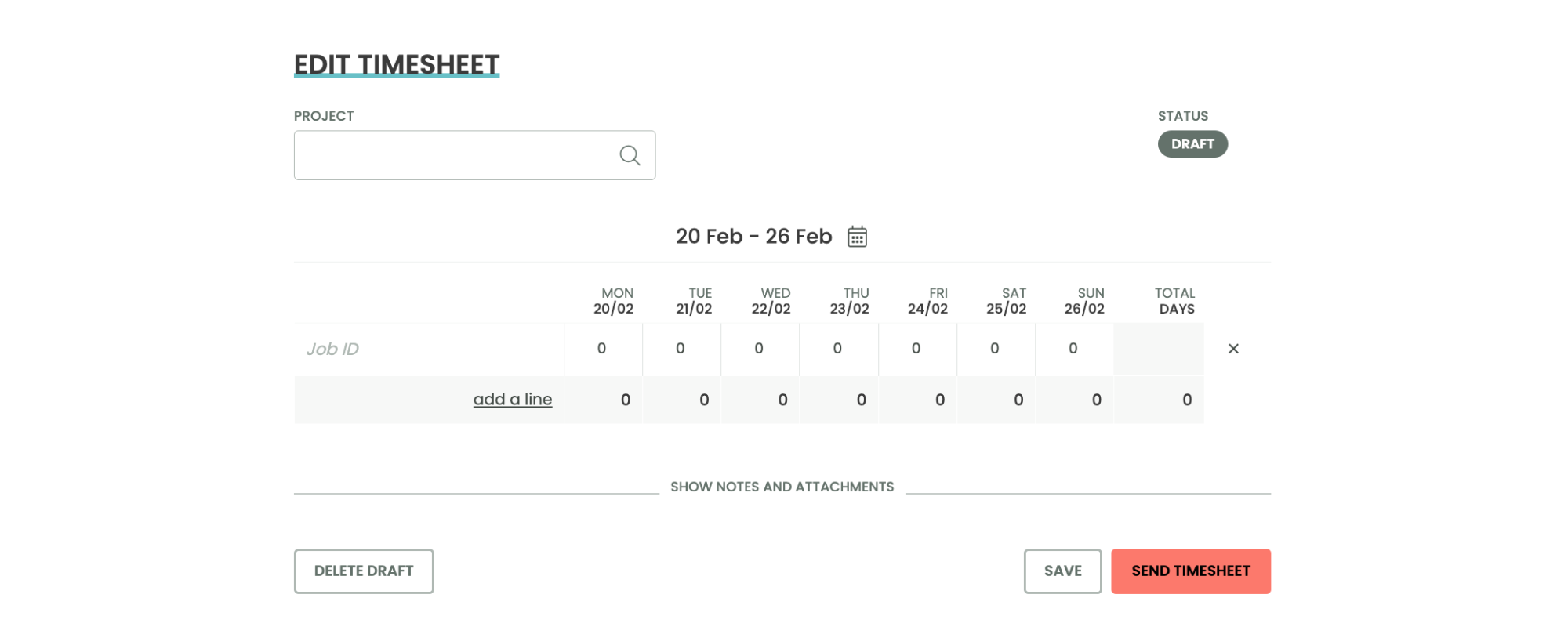

You will need a place where you can record your time on jobs and create invoices for your clients. The great news is there are a plethora of great accounting products that do this brilliantly like Rounded(AU), Xero or Quickbooks With marketplaces like &FRIENDS, freelancers are also able to create and send invoices & timesheets from within the platform.

4. Get your finances in order early

It goes without saying that getting your finances in order is critical for a healthy business. Specifically for freelancers, it will help with your cash flow as well as ensuring that its easy and painless to squirrel away funds for tax and super.

Getting a good accountant on board early is safe bet way of getting the right advice to set up your finances right from day one. However if you want to do alone, I’ve modified a list from a great article written by Devon Delfino summarising the key aspects of financial planning for freelancers:

Track your income

Having a historical view of your freelance income can help prepare you for busy and slow times during the year, she says, especially if you have repeat clients or seasonal projects. Those types of insights can bring some financial stability to the irregular freelancing world. Having a separate bank account can make it easier to track freelance-related money coming in and going out. A simple spreadsheet or free app can then help you devise and manage a budget.

Set aside money for taxes & super

While an employer withholds taxes and super for its employees, freelancers are responsible for making payments themselves. For taxes, Freelancers must make an educated guess of their annual earnings and make estimated quarterly payments to stay on track. If possible, use last year’s tax returns as a baseline or do research your tax brackets. Likewise, putting aside funds for your retirement is crucial and should be handled in a similar way.

Create a budget

Budgeting may seem daunting when you’re a freelancer, but it doesn’t have to be. The 50/30/20 method is a good place to start. It allocates 50% of your after-tax income for necessities, 30% for stuff you want but don’t need, and 20% for savings and paying down debt. This budget should factor in living expenses, emergency funds and paying off debts.

5. Create a strong shareable profile

In the advertising and digital industry particularly, clients always prefer to see examples of your work and your contract history. They also ideally want to see recommendations from people in the industry they trust.

For this reason, creating a strong profile or portfolio site is key to creating the best version of you to share with prospective clients. &FRIENDS is the only solution that allows you to unify all parts of your freelance story into one place, including your expertise, history, availability and examples of work. You can also create your own shareable URL. Visit &FRIENDS to build your own profile

6. NETWORK

Networking is an important part of marketing yourself as a freelancer. Here are some tips on how to network effectively as a freelancer

- Industry events: Look for events in your industry and attend as many as possible. These events are great opportunities to meet potential clients, as well as other freelancers who can offer advice and support.

- Join online groups: Join online groups, such as LinkedIn groups and Facebook groups, that are related to your industry. These groups are great places to connect with other freelancers and potential clients.

Connect with other freelancers: Reach out to other freelancers in your industry and ask to connect. They can offer valuable advice and support, and may even refer clients to you. - Be active: Participate in discussions, share your own experiences and be helpful to others. This will help you to build relationships and establish yourself as a valuable member of the community.

Networking takes time and effort, but it can be a valuable way to find new clients and stay informed about industry trends. Remember to be persistent, professional and to focus on building relationships.

7. Get started

One of the biggest things holding freelancers back is the idea that everything has to be perfect. While it’s important to make sure the work you deliver is of a high standard, remember that your services can be tweaked, your processes streamlined and your online presence worked on as you progress in your life as a freelancer. The most important thing is to get started and monitor as you go.

Pingback: Getting rebooked on freelancer projects

Thank you! https://wordpress-677497-3860291.cloudwaysapps.com/index.php/2023/10/16/navigating-the-gig-economy-freelancing-success-stories/

Pingback: 6 Key Strategies to Book Freelance Gigs and Outshine Competitors